Welcome, member! Pay your premium to keep the 2024 coverage you deserve. Pay Now

Tax Information

Earned income tax credit (EITC)

Ambetter Health members may qualify for the Earned Income Tax Credit, meaning there may be extra money waiting for you. See if you qualify.

Advanced premium tax credit (APTC) helps you save on your Ambetter Health premiums.

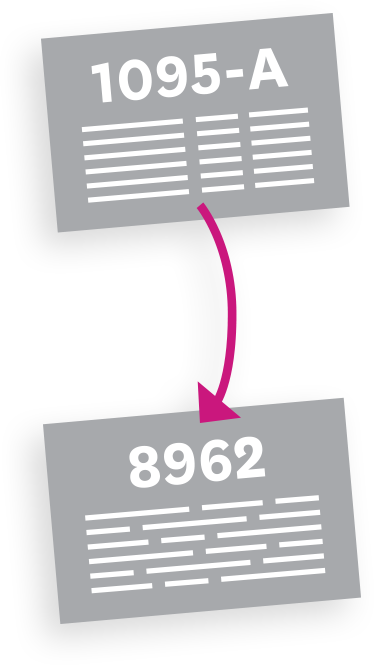

Here's a reminder about the two important forms you'll need when you file your return this year.

You’ll receive a 1095-A Health Insurance Marketplace Statement. You should see this form in the mail by mid-February. You can also download your 1095-A through your Healthcare.gov account.

Use your 1095-A to file Form 8962 with your tax return.

These two forms will determine the amount of your tax credit. If you file a paper return, you can get Form 8962.

Using these two forms to file your taxes correctly and on time is very important!

If you don't, you may lose your tax credit, resulting in higher premiums and possible loss of coverage. Don't forget: the filing deadline for your federal taxes is April 15, 2024.

Frequently Asked Questions

The APTC can help make your healthcare premiums more affordable, with an average credit amount of $491 per month.

To be eligible:

- Your household income for the year has to be between 100-400% of federal poverty line (FPL)

- You can’t be eligible for a government program, e.g., Medicaid, Medicare, CHIP, or TRICARE

- Your tax return filing status can’t be “Married Filing Separately.”

If you had a Health Insurance Marketplace plan in 2023, you should get Form 1095-A (Health Insurance Marketplace Statement) by mail no later than mid-February.

Your 1095-A may also be available in your HealthCare.gov account as soon as mid-January.

Your 1095-A includes information about Marketplace plans anyone in your household had in 2023, so you may receive multiple 1095-A forms if family members enrolled in different plans. You must have your 1095-A before you file, so don’t file your taxes until you have an accurate 1095-A.

If you enrolled through Healthcare.gov, log into your Healthcare.gov account.

Under "Your Existing Applications," select your 2023 application — not your 2024 application.

Select “Tax Forms” from the menu on the left.

Download all 1095-As shown on the screen.

Your 1095-A contains information about Marketplace plans any member of your household had in 2023, including:

- Premiums you paid

- Premium tax credits you used

- A figure called “second lowest-cost Silver Plan (SLCSP)

You’ll use information from your 1095-A to fill out Form 8962 (Premium Tax Credit). This is how you'll find out if there's any difference between the premium tax credit you used and the amount you qualify for.

- You changed Marketplace plans during the year

- You updated your application with new information — like adding or removing a family member, or moving — that resulted in a new enrollment in your plan

- Different household members had different plans

- If there are more than 5 members on the same plan

Visit healthcare.gov for more information.

You’ll get a 1095-A too. Part III, Column C should be blank or have the number “0.”

If you want to see if you qualify for a premium tax credit based on your final income, you can complete Form 8962 to find out.

If you don't qualify for a premium tax credit, you don't have to include Form 8962 when you file your income taxes.

Your 1095-A should include information for only the months you had a Marketplace plan.

The "monthly enrollment premium" on Form 1095-A (Part III, Column A) may be different from the monthly premium you paid. This doesn’t always mean there are errors, because:

- Your plan included benefits in addition to the essential health benefits required by the health care law, like adult dental or vision benefits. In this case, the monthly enrollment premium on your Form 1095-A may show only the amount of your premium that applied to essential health benefits.

- You or a household member started or ended coverage mid-month. In this case, your Form 1095-A will show only the premium for the parts of the month coverage was provided.

- You were enrolled in a stand-alone dental plan and a dependent under 18 was enrolled in it. In this case, the monthly enrollment premium on your Form 1095-A may be higher than you expect because it includes a portion of the dental plan premiums for pediatric benefits.